I’m obviously biased when discussing the importance of financial planning. However, I’d like to present some findings that may (or may not) surprise you. At the end, you’ll find a FREE offer from us to reward you for looking into this further.

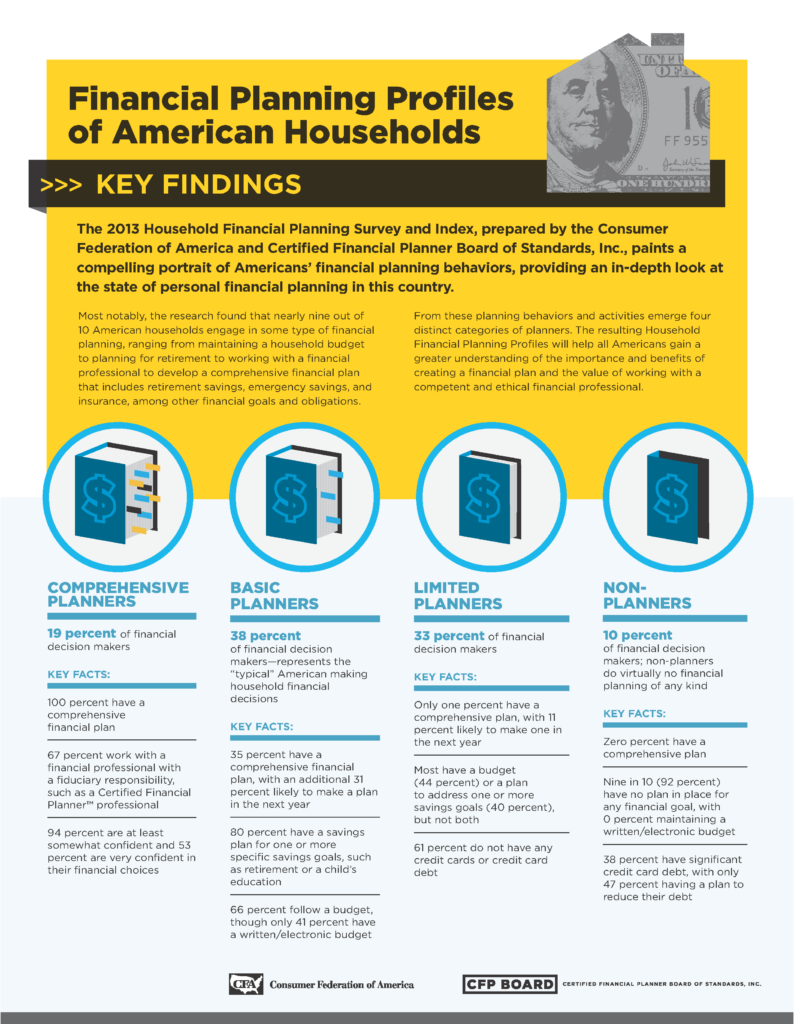

According to new research sponsored by the CFP Board and Consumer Federation of America (CFA), close to nine in ten American households are engaged in some type of formal or informal financial planning but the extent of this planning varies greatly.

The research shows that only one in five household decision makers (19%) are comprehensive planners, who take a methodical approach to financial planning, while one in ten (10%) do virtually no financial planning at all. The research further identifies nearly two-fifths of households (38%) as basic planners and one-third of households (33%) as limited planners. For more detailed information on the study, click on the image below.

One of the most compelling findings is that the more extensively households plan, the better prepared they are financially in terms of their likelihood of saving, investing, and managing credit card debt; the higher the effectiveness of this saving, investing, and debt management; and the higher their confidence in managing their finances. While higher income households are more likely than lower income households to plan, more than half (54%) of comprehensive planners have annual incomes below $100,000.

CFA and the CFP Board undertook the research with assistance from Princeton Survey Research Associates International (PSRAI), which surveyed a representative sample of 1,002 financial decision makers nationwide from April 12 to 24, 2013. The survey included more than 60 questions and has a margin of error of plus or minus three percentage points.

Now is the time to develop a comprehensive plan to navigate through unusual financial times, and gain what money can’t buy: peace of mind. If you would like to set up a time for us to do a FREE financial review together and provide detailed answers to any questions you might have, please call 913.402.6099 or send an email to [email protected].

John P. Chladek, MBA, CFP® is the President of Chladek Wealth Management, LLC, a fee-only financial planning and investment management firm specializing in helping families and couples who are not yet retired realize their financial goals. For more information, visit http://www.chladekwealth.com.