Few words characterize today’s financial markets like uncertainty. When overseas economic issues can rob investors of months of gains and speeches by Federal Reserve officials cause markets to flip-flop unpredictably, investors are left wondering what they should do. In an attempt to make major market movements work for their portfolios rather than against, some investors attempt to time the market.

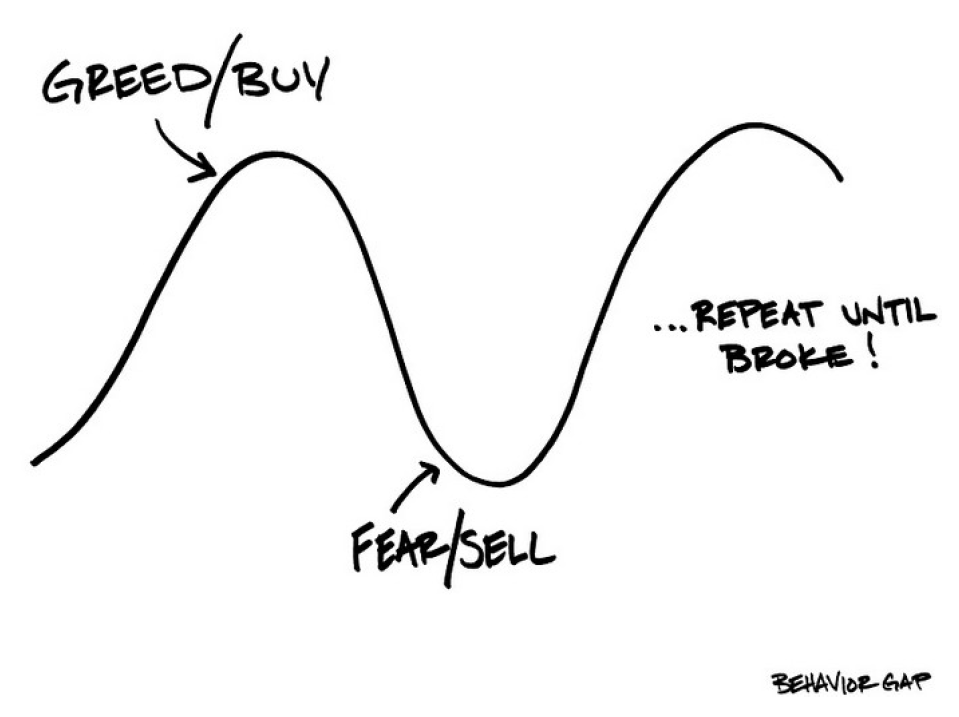

Market timing is the strategy of trying to predict future market movements to time buying and selling decisions. When markets are rallying or pulling back, it can be very tempting to try to seek out the top to sell or the bottom to buy. The problem is that investors usually guess wrong. Can the cost of trying to time the market make a big difference in your returns? You bet it can.

The average investor misses out on performance in part because their money tends to come in near the top and come out at the bottom. Investors are notoriously bad at picking the right time to enter or exit investments; by the time most investors feel the time is right to invest, many times the investment is at or near its peak. Corrections are a normal part of market cycles and periods of high growth often occur very close to major pullbacks. Investors who sell during the bad times frequently miss out on the best days of performance. If you’re not in the stock when it moves, you may miss out on the whole play.

Bottom line: It’s virtually impossible to accurately find the top or bottom of the market consistently. Developing a personalized investment strategy and making prudent adjustments when conditions warrant is a much better long-term strategy than making emotional investing decisions.

Does that mean that investors have to passively wait out every market (e.g., buy and hold), hoping that the next big decline doesn’t take out their life savings? Definitely not. There’s a big difference between trying to time markets and making strategic shifts to try to avoid major market declines.

Conclusions

Research and long experience have taught us that successful investing requires discipline and the patient execution of a long-term strategy, most especially when it is emotionally difficult; in fact, that is usually the time when opportunities are greatest. We understand that market timing has a tempting simplicity to it – buy low and sell high. However, it’s pretty hard to correctly predict the tops and bottoms of markets and most investors get it wrong. Remember, you don’t have to be the first to the party or the last to leave to have fun – often, just being there when it matters is enough to help you achieve your financial goals.

John P. Chladek, MBA, CFP® is the President of Chladek Wealth Management, LLC, a fee-only financial advisor with a fresh approach to financial planning and investment management. Committed to busy professionals and entrepreneurs in Kansas City. For more information, visit https://www.chladekwealth.com.