Social Security provides an important source of guaranteed income for most Americans. Choosing the right claiming strategy is even more important under new Social Security regulations.

For most Americans, Social Security will provide a significant portion of their income in retirement. According to Social Security Administration (SSA) statistics, Social Security benefits account for about 34 percent of retirement income for the average American. One of the biggest mistakes today’s retirees can make is to underestimate the importance of Social Security in their retirement strategies. In an era of vanishing pensions and volatile markets, Social Security offers government-guaranteed income that isn’t vulnerable to market risk, can’t be outlived, and can provide for your loved ones after your death.

The Social Security landscape changed dramatically in 2015 when Congress abolished several advanced claiming strategies that helped retirees increase lifetime income. The new rules make it more important than ever to make informed decisions when incorporating Social Security into your overall financial strategies.

In this post, we will learn more about your benefits and how to help maximize your household’s lifetime income from Social Security. Take note of any thoughts or questions you may have as you read so that you can discuss your personal situation with a qualified financial professional.

1. Your Age Affects the Benefit You Will Receive

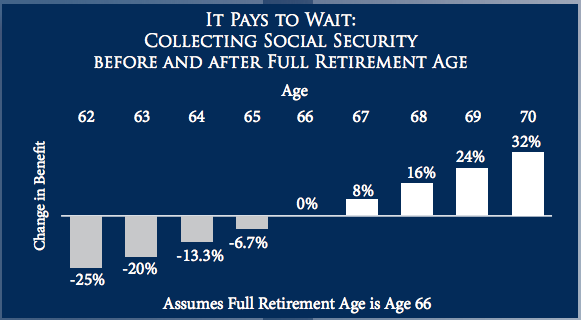

The earliest age at which you can file for Social Security (unless you qualify for disability) is 62, but you won’t be able to collect your full benefit then. Instead, the SSA reduces your benefits by 25 percent if your full retirement age (FRA) is 66 or by 30 percent if it’s 67. So, if your full monthly benefit at age 66 were $1,000, you’d only receive $750 each month if you started collecting at age 62. That reduction in benefits will be permanent.

You will be eligible to collect 100 percent of your benefit at your FRA, which is age 66 for anyone born between 1943 and 1954, 66 plus a two- month delay per birth year for those born between 1955 and 1960, and age 67 for anyone born after 1960. For example, if you were born in 1951, your FRA is 66. If you were born in 1956, your FRA would be 66 years and four months.

Many Americans are forced to file for benefits early for financial reasons, which can cost them dearly in lost income. If you can afford to wait until your FRA, you’ll be eligible for 100 percent of your Social Security benefit. If you can afford to wait even longer, your benefit will increase by up to 8 percent every year until age 70, permanently. So, if your basic benefit were $1,000 at your FRA of age 66, it would increase to $1,320 per month, or 132 percent of your benefit, by waiting until age 70 to take it. If you were born after 1942, you’ll qualify for the 8 percent credit each year.

SOURCE: SSA.GOV (DOES NOT INCLUDE COST-OF-LIVING INCREASES)

2. Even under the New Social Security System, It May Make Financial Sense for at Least One Member of a Couple to Delay Claiming Benefits Until Age 70.

Many retirees wrestle with the question, “When is the right time to file for benefits?” There is no perfect time to file for benefits, but choosing the right claiming strategy can radically affect how much you can collect over your lifetime. Many Americans are forced to claim early benefits for financial reasons, but, if you can afford it, delaying Social Security benefits could mean collecting significantly more over the course of your life.

If either you or your spouse expect to live past the age of 80, you’re generally better off waiting to claim as long as possible to receive a larger benefit.

However, if your health isn’t good or you need the income, you might want to consider claiming Social Security benefits early.

Ultimately, your personal Social Security strategy will depend on many personal factors like taxes, marital status, age, health, and other sources of income. It’s a good idea to discuss your situation with a financial professional who can analyze your situation and offer personalized advice.

3. Remember: Social Security Benefits Are Taxable!

Unfortunately, retirement doesn’t mean retiring your worries about taxes. If you collect substantial income from sources like wages, investment income, rental income, or any source that you report on your tax return, you will very likely owe taxes on your Social Security benefits. The tax rate you’ll pay depends entirely on your overall income bracket since Social Security gets treated like ordinary income.

However, there are strategies that may help you maximize your income while reducing taxes. For example, one method is to take as much income as possible from sources that are excluded from the “provisional income” that the SSA uses to calculate the taxation of your Social Security. According to IRS rules, income from the following sources may potentially be excluded from provisional income calculations:

• Roth IRA distributions

• Non-taxable pensions and annuities

• Inheritances and gifts

Please keep in mind that taxes are just one piece of your overall financial picture and it’s important not to let them overshadow other critical factors. If you are concerned about the effect of taxes on your retirement income, we strongly recommend that you speak to a qualified financial professional.

4. Married? Don’t Forget about Spousal and Survivor Benefits

Married couples need to think about how their Social Security claiming strategies will affect their spouse’s benefits and income in retirement. This issue is especially important when one spouse is significantly older than the other or earned more during a career. If your spouse isn’t eligible for a personal benefit, his or her benefits are based on your personal benefit, which means that the age at which you file for benefits will have a major impact on what he or she is eligible to collect.

Many couples prioritize maximizing a survivor benefit for a younger spouse when developing a Social Security claiming strategy. Since a survivor who has reached FRA will be eligible for 100 percent of the primary worker’s benefit, he or she will be able to take advantage of any delayed retirement credits and cost-of-living adjustments that the primary earner accumulates. Bottom line: the longer you wait to collect Social Security, the more your spouse will be able to claim as a widow or widower. Generally, surviving spouses can choose between collecting a personal benefit or a survivor benefit, depending on which one is higher.

5. Paying Attention to Social Security Is More Important Than Ever under New Rules

On November 2, 2015, President Obama signed into law a bipartisan budget deal that affected two strategies that helped retirees increase their lifetime benefits by claiming income now and claiming more income later: file-and-suspend and restricted applications for benefits.

The new regulations kick in on May 1, 2016, and will mean that many retirees will lose access to these advanced strategies after that deadline. Based on our current understanding of the new regulations

• Retirees who are not at least 62 by January 1, 2016, will no longer be able to choose between receiving a spousal benefit or receiving their own benefit. They will be “deemed” as filing for both and receive the larger of the two benefits without accumulating additional credits.

• After May 1, retirees will not be able to file and then suspend their own benefit while triggering benefits for a spouse or child. Instead, they will have to receive their own benefit to allow a family member to collect on the primary record. They can still suspend a benefit to accrue credits, but a spouse cannot receive a benefit while it is suspended.

• Retirees who suspend their benefit will no longer be able to receive their suspended benefits in a lump sum before age 70.

• Retirees who have already taken advantage of the old rules (or do so before the deadline) will be grandfathered in and not affected.

Social Security is a foundational element of a retirement income strategy, and the new rules may affect your financial picture. If you had planned to use one of these Social Security benefit strategies to increase your income in retirement, then you will need to revisit your income assumptions to help ensure that you have enough to live comfortably. However, there are still ways to increase the amount of Social Security benefits you can claim.

Married couples will still be able to take advantage of other advanced claiming strategies such as delaying one spouse’s benefit to accrue extra credits while the other claims a personal benefit. You can potentially improve your retirement income picture by

• claiming benefits late to earn additional retirement credits,

• minimizing taxes paid on your Social Security benefits,

• maximizing survivor benefits for yourself or your spouse.

No strategy can be right for everyone, and it’s important to consider your entire financial picture when making decisions about Social Security. As with many financial strategies, details matter, and things like age differences between you and your spouse, taxes, and life expectancy can all affect your overall outcome.

Under the new Social Security rules, making informed decisions about when to file is critical to making the most of your benefits.

Conclusions

We hope that you’ve found this special report educational and informative and that you have come away with some ideas for how to help optimize your Social Security benefits. For many retirees, Social Security benefits are the cornerstone of their income strategies and account for a significant percentage of their income. It’s critical to plan ahead now so that you can make the most of this invaluable resource. Every strategy will not work for every retiree, which is why it’s so important to take the time to analyze your needs and test possible scenarios.

The new regulatory environment means that it’s more important than ever to understand your Social Security options. The moral of the tale is this: you cannot depend on a single financial or retirement strategy to build a comfortable retirement. One of the benefits of working with a financial professional is that we keep track of changing retirement issues. We can help you analyze your financial situation and develop personalized recommendations designed to help you leverage Social Security in light of your overall financial goals.

John P. Chladek, MBA, CFP® is the President of Chladek Wealth Management, LLC, a fee-only financial advisor with a fresh approach to financial planning and investment management. Committed to busy professionals and entrepreneurs in Kansas City. For more information, visit http://www.chladekwealth.com.