Our financial market is in a volatile state. Stocks are down, inflation is sky high, interest rates are increasing, and faith in the market is dwindling.

When financial instability becomes mainstream, many people’s thoughts and attitudes toward their money follow suit. This phenomenon is known as market psychology, and market psychology represents the overall sentiment investors carry toward the stock market at any given time.

And right now, it’s not all that pretty.

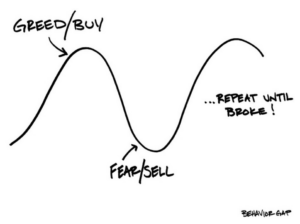

Market psychology has power and can trigger “knee-jerk” reactions from investors, affecting the economy’s overall health.

Feer, greed, and performance expectations feed into the current state of market psychology, but it doesn’t have to be that way.

You can leverage market psychology for “good” and use it to form healthy, long-term investing habits to help you reach your goals.

But if you’re struggling with where to start and how to fight off those negative feelings you may be harboring every time you check your account balances, these six tips are for you.

1. Know The Market And Your Place In It

When it comes to a wobbly market, knowledge is power. Understanding how the market works is the first step to harnessing your thoughts, emotions, and actions toward it. Let’s start by understanding two of the most pressing market conditions:

- Bull markets—stock prices are healthy, consistent, and rising

- Bear market—stock prices fall at least 20%

These market trends can also dictate market psychology and, ultimately, investors’ behavior. When the markets are consistent and doing well (a bull market), people are keener to buy stocks and invest. Conversely, when stock prices fall in a bear market, people can get anxious and want to pull back from investing.

But here’s the thing: the state of the market shouldn’t be the main thing you consider when deciding when and how to invest.

To understand your place in the market, you’ll need to know a few things:

- Your financial goals. Knowing what you want and hope to gain is perhaps the most important part of investing. You want to invest with purpose and intention and can do that when you take a goals-based approach.

- Your risk tolerance and risk capacity. Risk is always a part of investing, but you can tailor your risk as you move through different stages of your life. Together, we can create a risk management plan that lets you sleep at night and helps you move the needle toward your goals.

- Desired asset allocation. Your asset allocation highlights what type of securities you invest in, like stocks, bonds, real estate, etc.

- Time horizon, aka how long you have until you reach your goal, like 30 years until retirement, 10 until your child goes to college, etc.

Cultivating knowledge about how the market works and your place within it gives you the backdrop needed to create a strong plan.

2. Become A “Far-Sighted” Investor

If you’ve ever been to an optometrist for an eye exam, you may have been told that you’re either near-sighted (you can see better close up) or far-sighted (you can see better farther away). It’s much more common to be near-sighted (33%) than far-sighted (5%).

The same is true for how we tend to look at financial markets.

It’s way more common for us to be near-sighted regarding market movements and short-term volatility. Your heart may soar when stocks are high and fall as prices do. And that makes sense. Our instinct is to monitor and protect what’s right in front of us.

But to create a compelling investment strategy, we have to zoom out and focus on the future, the far future.

When you become far-sighted about the market, you tend to look at historical trends and overall market performance. And long term, the market seems pretty rosy. For example, the S&P 500 boasts an average of 10.67% annualized returns since 1957.

Playing the long game also helps you avoid the temptation to time the market. Whenever markets are down, we like to placate ourselves with false allusions and stories like “I saw this coming,” or “I should cash out my investments before things get worse,” or “We’re not at the lowest point yet, so I should wait to buy.” The list goes on and on.

But timing the market isn’t a tool to help you get where you want to go; instead, it could hold you back from reaching your full potential.

3. Recognize And Plan For A Spectrum Of Emotions

Investing is sold as a logical and analytical practice, but that’s not the whole story. Emotions might be the protagonist driving the narrative forward.

Why?

Because emotions impact your behavior, and your behavior has a lot to do with your overall financial success.

When the markets drop (whether a little or a lot), you might start to feel some negative emotions. Those negative emotions lead to thoughts and questions that aim to get you out of that present testy situation, which can lead to costly actions like cashing out investments or making drastic changes to your plan.

On the other hand, emotions that are often seen as positive, like confidence and optimism, could also lead to making decisions that negatively affect your portfolio, like becoming concentrated in company stock.

As you go about your investment journey and manage market psychology, it’s critical to determine where your emotions come into the mix. By recognizing and understanding your full spectrum of emotions, you’ll be less likely to let them influence your investment decisions. A professional can also help you keep your emotions in check and ease your concerns when the market takes a tumble or a climb.

4. Don’t Let Downturns Color Your Investment Experience

Negative market experiences, like bear markets and prolonged recessions, can cast a dark light on your investment journey and encourage you to make certain decisions that may not have your long-term, far-sighted interests at heart.

Like the sun rises after the darkest hours, some of the market’s strongest days come right after the worst ones. And missing out on those “best” days because you pulled funds out can stunt your net returns over time.

Whether you want it to or not, the future is coming, and you get to decide your place within it. It’s better to be part of the plan and call the shots so you can reap the rewards.

Again, looking at the market from a long-term perspective will help significantly. When you do that, you’ll be able to focus not only on what is but on all that is to come.

5. Prioritize The Good Of The Many

One stock can’t save your portfolio.

Let’s say that again; one stock can’t save your portfolio.

One investment’s performance isn’t going to define your “success” or “failure” as an investor. The market is so much more nuanced than defining it only in terms of your wins and losses within it. Instead, it’s about cultivating a custom strategy that’s focused and durable throughout various market conditions.

It’s also not uncommon to experience market wobbles at several points throughout your investment journey. But those experiences can lead to negative associations with the market as a whole, which might keep you from investing the way you should to reach your goals.

6. Compare The Costs Of Fording The Market Alone

Creating a long-term investment portfolio that balances your risk, deftly adapts to market movements, and helps you reach your financial goals is a team sport. By not reaching out for professional guidance, you place all the burden of investment creation and ongoing management on your shoulders—no wonder you’re tired!

While you may think that DIY-ing your financial plan saves you money, consider the non-monetary expenses that go into it.

- How many hours do you spend a week or month managing your finances?

- How much of that time is productive, and how much of it leaves you feeling more confused than when you started?

- What are you not doing by spending time on your investments? It might be time with your family, pursuing your hobbies, or valuable relaxing/recharging time.

Managing your portfolio how you want and need to requires valuable time, deep market knowledge, and implementing the right actions for you and your family. A seasoned investment professional can do the heavy lifting for you, help you tune out the noise, and construct a tailored investment plan that helps your family get where they want to go.

While there are monetary costs, you must consider (transaction, administrative, brokerage, advisor fees, etc.), working with a professional that gives you a strong plan, guidance, and peace of mind can transform your financial life.

Make Your Market Psychology Positive

As you continue your investment journey, it’s important to understand that the market will always do three things (in no particular order):

- Go up

- Go down

- Stay the same

Working with a professional can help you create an investment strategy that understands the market’s behavior and helps you carve an individual place within it to reach your goals.

One of the most productive things you can do for your portfolio is to remain calm when the financial markets turn choppy. We know from scientific research that behavior can be the biggest challenge to ensuring financial success over the long haul.

When we become emotional about the markets, our behaviors will often conflict with the long-term strategy of our investing plan. To learn how your emotions might be playing into your investor-related decision-making, schedule a call with our team today.

Updated: 08/2022

All investment and financial planning strategies involve risk of loss that you should be prepared to bear. We cannot guarantee any investment performance whatsoever, and past performance is not indicative of potential future returns.