On Thursday, October 13, 2022, the Social Security Administration (SSA) released important updates for 2023, including cost-of-living adjustments (COLA) for retirees, changes to Medicare premiums, and retiree earning limits.

Are you wondering how these adjustments affect your wallet? Let’s dive into what you need to know about the critical changes ahead.

1. Thanks To COLA, SSA Benefits Are Increasing

The adjustments stem from the 2023 Social Security Administration Cost-of-Living Adjustment (COLA). COLA aims to ensure that retirees and other dependents retain their purchasing power amid inflation.

The SSA bases the COLA on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers from the third quarter of last year. If there is no increase in this index, there won’t be a COLA that year.

The Social Security Administration has thrown retirees a lifesaver in response to record-breaking inflation.

Social Security and Supplemental Security Income benefits for more than 70 million Americans will increase by 8.7% in 2023. This change equals an average monthly boost of over $140 starting in January 2023.

What does this look like for the average beneficiary?

The current average monthly benefits for retired workers is $1,681.

After the 8.7% COLA is in effect, that monthly average bumps to $1,827.

For couples both receiving benefits, the average moves from $2,734 to $2,972 after the 8.7% COLA increase.

The entire breakdown is available here.

This COLA marks the largest increase in 40 years. When inflation increases, like it has this year, the cost of living also rises.

The COLA assists in offsetting inflation and higher cost-of-living expenses for millions of Americans, ultimately helping retirees maintain their lifestyle and protect their income against higher living expenses.

2. Medicare Part B Premiums Are Decreasing (For Some)

There’s even more good news for seniors; Part B Medicare premiums are decreasing.

This announcement is newsworthy because it’s the first time in over a decade that Medicare premiums aren’t rising.

What does this look like for the average person enrolled in Medicare Part B?

The current monthly premium for Medicare Part B is $170.10. It will drop to $164.90 in 2023. For reference, the premium was $148.50 in 2021.

Before you start happy dancing, it’s important to know that you’ll have to pay a higher premium if you earn more income. While the base level is $164.90, you only access that amount if your income fits the qualifications.

You will have to pay a higher premium if your modified adjusted gross income (MAGI) is more than:

- $97,000 if you file single or married filing separately. (2023)

- $194,000 for married couples filing jointly. (2023)

This leads us to Medicare IRMAA.

Medicare IRMAA

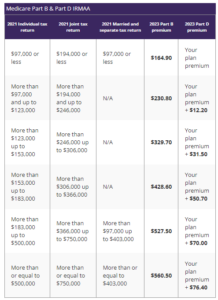

Medicare IRMAA is a surcharge to your Part B and Part D premiums if your income exceeds the annual thresholds. The SSA determines who pays IRMAA based on your tax return from two years ago. They use that data to see if your MAGI falls within their allowable ranges. If it doesn’t, you’ll have to pay more.

For example, if you filed your federal tax return individually and your MAGI in 2021 was less than $97,000, you will pay the standard Medicare Part B premium ($164.90) in 2023. If your MAGI is more than $97,000, you will pay an IRMAA.

Below is a breakdown of IRMAA adjustments to monthly premiums.

But there are ways to target IRMAA proactively. One is by strategically managing your MAGI in retirement. For example, if you’re between brackets, an extra Roth conversion (which bumps your income) could potentially mean thousands of dollars more in premiums. Be strategic with your retirement income and withdrawals to help manage the potential impact.

3. The Earning Limits For Retirees Is On The Rise

Reaching full retirement age (FRA) unlocks opportunities like receiving your full Social Security benefit, putting your spouse in the best position to collect their full spousal benefit, earning as much as you’d like without worrying about interrupting your benefits, etc.

Wait, you can technically earn too much in retirement? If you’re collecting Social Security benefits before full retirement age, yes. Here’s where the earnings limit comes into play.

The Social Security Administration puts a cap on how much you can earn if you’re collecting benefits before reaching full retirement age. If you exceed the annual thresholds (discussed below), the SSA will withhold a set portion of your benefits.

Don’t fret—this isn’t a permanent penalty.

As soon as you reach your FRA, they will slowly return those payments to you. But even though you get the money back, it often takes a lot of time to recoup all the funds.

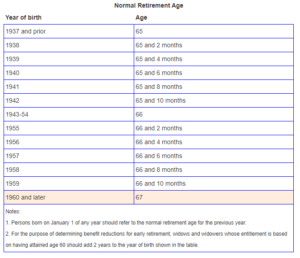

The SSA determines earning limits based on your full retirement age. Below is a chart to help you determine where you fall.

Once you know your FRA, let’s examine how the earning limits could affect you.

If you are under normal retirement age, the 2023 taxable earning limit is $21,240 per year ($1,770 per month).

If you reach your normal retirement age in 2023, the taxable earning limit is $56,520 per year ($4,710 per month).

Earn above those limits and you’re looking at the SSA withholding, $1 in benefits for every $2 in earnings above the threshold.

But the process is a bit less strict in the year you reach your normal retirement age. For every month before your FRA, the SSA will withhold $1 in benefits for every $3 you earn above the limit.

4. More People May Have To Pay Taxes On Their Benefits

We can’t forget about taxes! The SSA estimates that up to 40% of people have to pay taxes on their benefits.

Why does this matter? With a significant 8.7% COLA increase, more retirees may face an additional tax. This is important because even a slight increase in your taxable income can push you into a higher tax bracket and, subsequently, higher tax liability on your benefits.

So, how do you know if you have to pay income tax on your Social Security benefits?

- If you file an individual federal tax return and your combined income is:

-

- Between $25,000 and $34,000 – Up to 50% of your benefits may be taxed

- More than $34,000 – Up to 85% of your benefits are subject to income tax

- If you file a joint federal tax return with your spouse and your combined income is:

-

- Between $32,000 and $44,000 – Up to 50% of your benefits may be taxed

- more than $44,000 – Up to 85% of your benefits are subject to income tax

- If you’re married and file a separate federal tax return:

-

- SSA estimates that you’ll likely have to pay taxes on your benefits.

5. Workers May Have Higher Social Security Taxes

Remember, if you’re working, some of your income goes toward the Social Security trust via a payroll tax. The combined tax rate for Social Security and Medicare is 7.65% of your income.

While the Medicare tax doesn’t institute income caps, the Social Security tax does, and this year, it’s increasing.

But let’s break that down.

- Social Security portion – OASDI (Old Age, Survivors, and Disability Insurance)

- 6.20% on earnings up to $160,200

- Medicare portion

- 1.45% on all earnings

What does this mean for your wallet? If we compare the maximum taxable earning amount for OASDI to last year, $147,000, it’s an increase of approximately $13,000. So, more of your income could be taxable.

Raising the taxable limit could be one way to help shore up the Social Security benefits system since it’s running out of money. The hope could be that current workers would cushion the Social Security pot with increased taxes on wages. But many other things will likely need to happen to protect the program long-term.

Itching to get your new benefits? Starting in December, those receiving Social Security will be notified by mail of their new benefit amount. If you want to find out earlier, you can log in to your my Social Security account to view your notice online.

If you have questions or concerns about any of these changes for 2023, please don’t hesitate to reach out to us.

Disclaimer:

The contents of this article are for general information and educational purposes and should not be construed as specific investment, financial planning, tax, accounting, or legal advice. Please consult with a professional advisor before taking any action based on the contents of this article.

All investment and financial planning strategies involve risk of loss that you should be prepared to bear. We cannot guarantee any investment performance whatsoever, and past performance is not indicative of potential future returns.