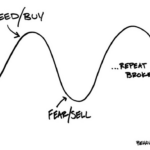

Few words characterize today’s financial markets like uncertainty. When overseas economic issues can rob investors of months of gains and speeches by Federal Reserve officials cause markets to flip-flop unpredictably, investors are left wondering what…

Read More